AD&C Lending Conditions Continue to Ease

Kennesaw’s Ashford Capital Partners’ Managing Partner Matthew Riedemann brings you news you can use.

Builders and developers continue to report easing credit conditions for acquisition, development, and construction (AD&C) loans according to NAHB’s survey on AD&C financing.

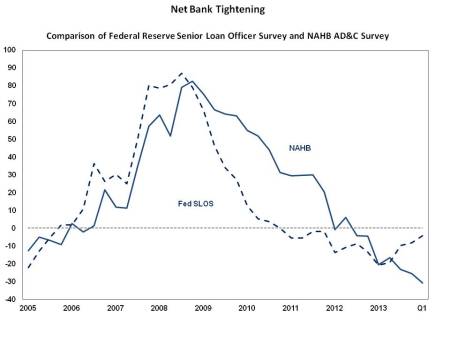

In the first quarter of 2014, the overall net tightening index based on the AD&C survey improved (i.e., declined) from -25.5 to -30.8. The index is constructed so negative numbers indicate easing of credit; positive tightening, so a lower negative index means greater easing. Meanwhile, a similar net tightening index from the Federal Reserve’s survey of senior loan officers edged up from -8.1 to -4.2. This is the third consecutive quarter that the two indices moved in opposite directions.

According to the NAHB survey, less than 15% of respondents report credit conditions worsening in the first quarter. For example, only 6% of NAHB members said availability of credit for land acquisition had gotten worse, compared to 33% who said it had improved.

Only 5% reported worsening credit conditions for single-family construction, compared to 46% who reported better conditions. Similarly, only 5% and 13%, respectively, said credit available for land development and multifamily construction was worse during the first quarter of 2014.

Among members who reported tighter credit conditions in the first quarter, the most common problems were requiring personal guarantees or collateral not related to the project (60%), reducing the amount they are willing to lend (55%), lenders simply not making new loans and lowering the allowable LTV (or loan-to cost) ratio (50% each).

Although commercial banks remain the primary source of credit for AD&C by a wide margin, private individual investors have emerged as a viable alternative, especially for A&D loans. Private investors were the primary source of land acquisition loans for 25% of NAHB members, of land development loans for 11%, and for single-family construction loans for 9%. For A&D loans, private individual investors were the second most common source of credit (they were third most common for single-family construction after thrift institutions). The second most common source of multifamily construction loans was housing finance agency programs (17%).

The percentages of builders and developers putting projects on hold until the financing climate improves were slightly higher than in the fourth quarter 2013. For land acquisition, the share putting projects on hold increased from 27% to 32%; for land development, the share increased from 27% to 31%; and for single-family construction, it went up from 17% to 20%. For multifamily construction, the share putting projects on hold increased from 13% in the fourth quarter of 2013 to 23% in the first quarter of 2014.

http://eyeonhousing.org/2014/05/20/adc-lending-conditions-continue-to-ease/