Entry-Level Bright Spots: Millennials

No doubt, underlying the current market’s uncertainty as to the strength of demand right now–whose most conspicuous symptom is the lack of participation of entry-level, first-time home buyers in the current recovery–is what’s keeping the Millennial cohort from behaving on par with trends for young adults entering the work place, starting households, getting families going, and buying houses.

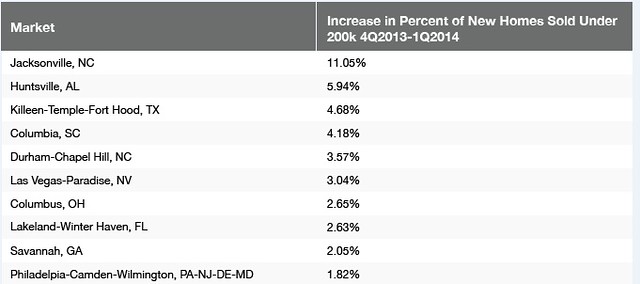

That said, we feel it’s important to point out, as is the case with so many issues, insights, and observations about housing right now, that painting a broad-brush picture of what’s going on in the market may be precisely correct, but may also give an inaccurate picture of where opportunities and directions lie. For instance, check out this heat-map of the nation’s 10 hottest markets for new entry-level, first-time buyer homes.

To arrive at this rankings, we took the top 50 markets for new homes sold under 200k in Q1 of 2014, determined what percentage of new homes sold in each of the top 50 markets were under $200,000; then, we ranked the percentage increase between Q4 of 2013 and Q1 of 2014 to come up with a sense of which markets are moving fastest relative to their base of new homes sold in the price-range.

Here, here, and here we have insightful pieces as to the reasons for the “failure to launch” among Generation Y adults.

When it gets right down to it, there’s a litany of reasons Millennials haven’t become the demand factor in the marketplace they’re going to need to be to make things really interesting for home builders and developers over the next decade or so.

* Access to credit constraints * Student debt * Tough, narrow, lumpy, choppy jobs recovery post- deep recession impacting household income levels * Difficulty-level coming up with down payment * Greater need for geographical flexibility earlier in careers * Gun-shy on homeownership thanks to earlier housing meltdown * Comfortable having roommates, or living with mom and dad

So, net net, just 36% of American adults under the age of 35 own their home, according to the latest Census Bureau data, down from 42% in 2007.

So, is this a snapshot in time, or a new chronic reflection of how things will remain? That’s the question. Still, let’s look further at the markets where entry-level first time buyers are anomalously strong in their market:

What we sense about these “bright spots” is that there are two things going on. One, is certainly that an external, economic and jobs context has contributed to first-time buyer demand, especially in the wake of the retreat of institutional investor buyers from these respective markets.

Too, though, we might look at these markets for what builders are doing operationally about the other side of the coin, supply.

It’s there that we expect the greatest amount of progress in the housing recovery. We know that home builders and developers can and will develop offerings that will be in price-ranges that can stir interest, but only when their supply chain of lots, materials, labor processes, and manufactured products can be ensured on a speedy and executionally excellent basis.

To do that, those builders, labor forces, materials suppliers, and manufacturers need more, better, faster, and cheaper talent to deliver on that pent-up need. This again comes down to a single word solution: Millennials.

Have a look at what Morley Winograd and Michael Hais have to say about how questions, uncertainties, doubts, and fears regarding both demand and supply in many industries and markets trace to that one made-up word: Millennials.

Come back tomorrow to www.AshfordCP.com/blog where Kennesaw’s Ashford Capital Partners’ Managing Partners Matthew Riedemann brings you news you can use.

By John McManus – http://www.builderonline.com/local-markets/entry-level-bright-spots_o.aspx?dfpzone=home&utm_source=newsletter&utm_content=jump&utm_medium=email&utm_campaign=BBU_060214&day=2014-06-02